$GME and the #OTCSET are very much of the same vein. The formula for a SET play is in essence this:

- Troubled stock is heavily targeted by hedge funds and/or market makers as being an easy opportunity to short any rallies because it’s destined to go to zero

- A paradigm shift occurs within the market which gives way to a path for a turnaround and possibly avoiding going bankrupt or to zero

- Shorts have over-leveraged themselves selling short and naked selling creating a huge imbalance in long term supply vs demand dynamics

- In the event of survival, all shorts become assets on the balance sheet and sets the stage to add lots of fuel to the secular bull trend

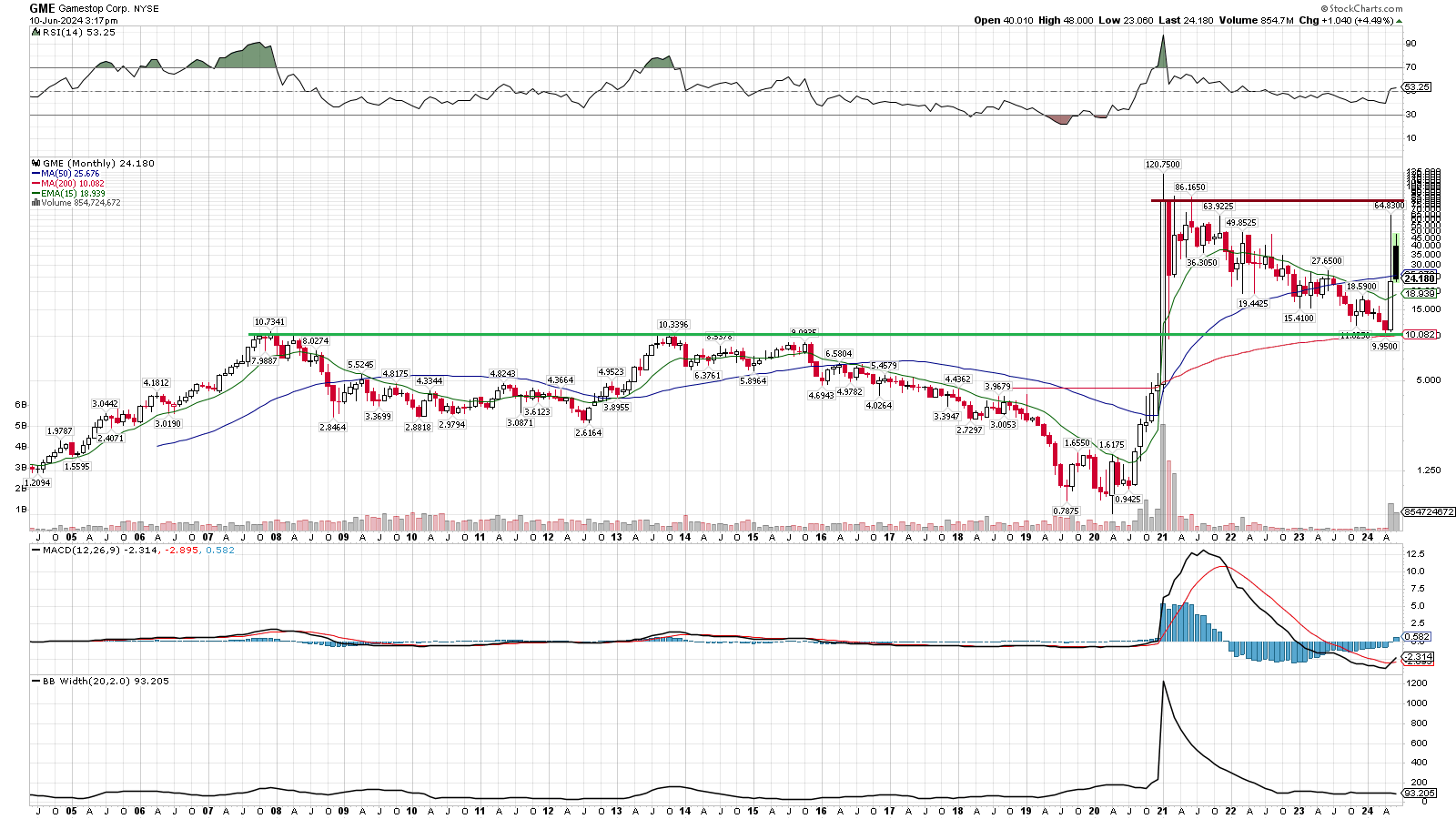

The formula for $GME is more or less the same thing with it’s own narrative. It was heavily targeted by shorts who assumed it was going to zero, because brick and mortar businesses are dying off. A paradigm shift occurs and the stock breaks out to new all time highs in 2021. The stock has managed to stay above it’s old base while the market works to readjust to the new paradigm.

It’s not a coincidence that $GME made it’s move right when the OTC shells were all heating up and doing their thing. It’s my belief that as $GME goes, so does the OTC and especially these #OTCSET plays. $GME is the harbinger of destruction for shorts, especially the naked variety.

$GME was looked at as being garbage because it was a dying business and a shell of what it once was. OTC stocks are looked at as garbage because historically they are and they often are literally just a shell. $GME is turning it’s ship around thanks to Ryan Cohen and company and the strong market for it is making it easier for them to raise capital and grow and evolve the business into something viable. The strong market for these shells will make mergers, acquisitions and growth in general that much easier for the shell owners, thanks in large part to the ease of being able to raise capital in this environment.

Is it possible that these guys will just use the opportunity to simply dilute and take the money and run? Sure, that’s always a risk. My belief though is there is too much intrinsic value in these clean charts, thanks to their potential for secular bull trends, as well as the baked in value of all the potential short covering to just waste it all on some dilution with no purpose. Not to say it won’t happen, it will, but there will also be a lot of examples of people taking full advantage of this scenario and doing things the right way. There’s way too much upside for any one of these shells, especially with the strongest long term charts/trends, and if they can survive and squeeze the shorts why wouldn’t they make the most of it.

These secular uptrends don’t happen on accident, just like the perpetual downtrends on most historical OTCs don’t happen on accident. Now the question is what’s happening exactly and what does the fallout look like? And can we get rich off of it?