Why bother with all the scanning, assessing and worrying about such long time frames, compiling, updating and refining the watchlists, and in general putting in so much time and effort for this very specific niche way to approach the OTC in it’s current evolutionary stage? Why am I going to such great lengths to write about and spell all of this out?

I think this is a phase the OTC market has never seen before, thanks to a confluence of circumstances all lining up. The regulation changes in 2021 flooded the market with clean shells and the global macro conditions have lent themselves to a steady increase in demand for the shells. I believe the phase we’re beginning to enter is going to present opportunities that can potentially change lives and I’m here to take advantage and spread the message and raise awareness so others can do the same. The more awareness is spread, the more this bull market will open up and blossom.

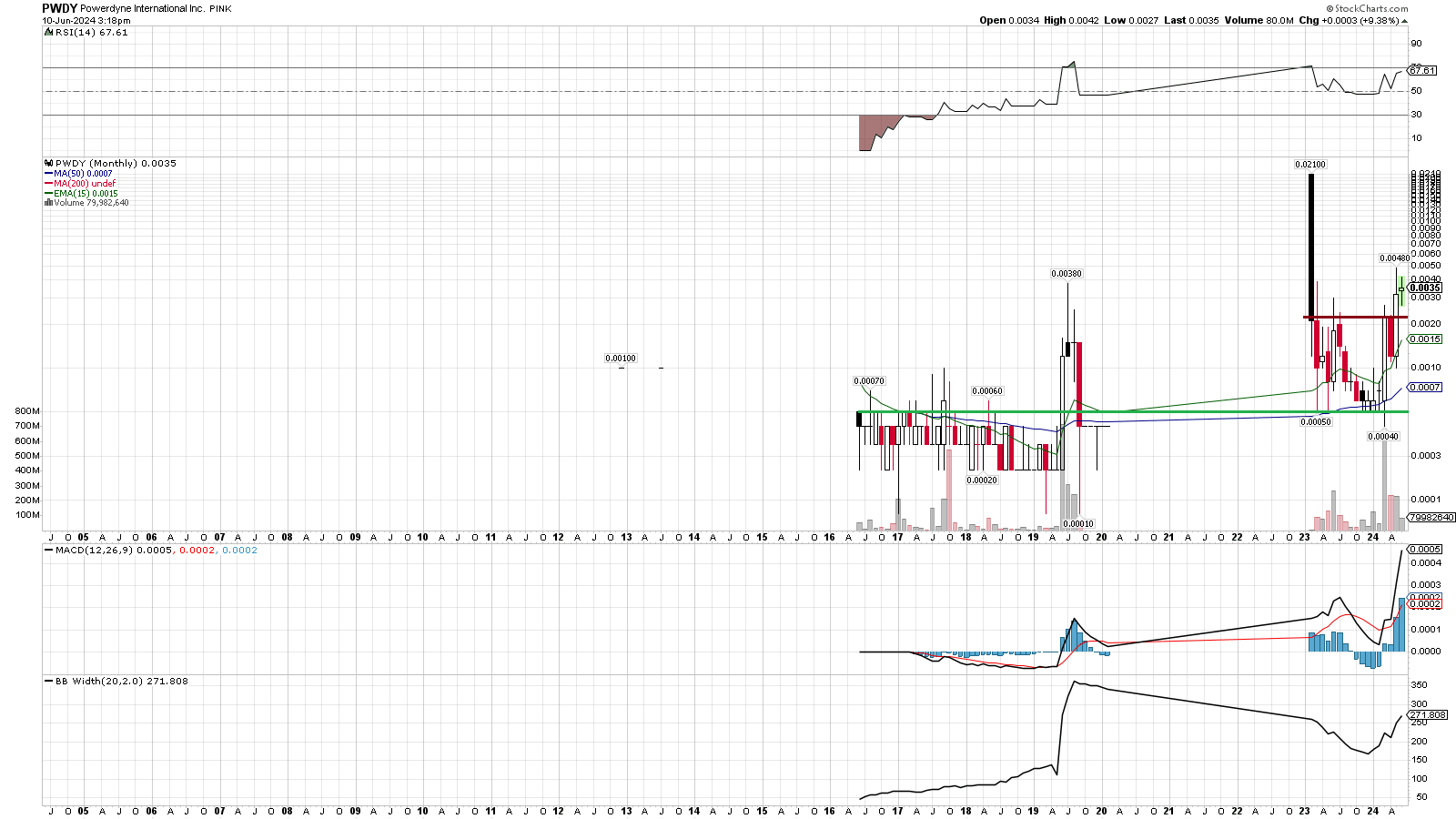

If a typical (by historical standards) OTC chart is mired in a never ending downtrend with occasional violent rallies that ultimately peter out and prove to be just another lower high in a perpetual series of lower highs and lower lows, then that means you historically will want to play OTC runners with that in mind. That’s why over the years OTC traders have been conditioned to be quick flippers, chasing the momentum and then moving on when it dies off.

If an #OTCSET chart is the antithesis of that historical norm, then that means the same methodology isn’t necessarily the best way to approach these, at least if you’re trying to maximize the potential upside. If a secular trend is bearish, you generally don’t want to hold the rallies too long and you don’t want to buy the dips – to overly simplify it. However if the notion behind the theory is that we’re seeing quite a large number of secular uptrends or the strong possibility of secular bullish continuation signals, then the idea of holding rallies for longer and buying dips becomes a much more intriguing idea to consider – again, to overly simplify it.

Don’t misinterpret this as a way of me saying that a SET chart will just go straight up – even if this theory proves to be 100% on the money that will not be the case. Even in a strong secular uptrend or bull market, there will still be a lot of resistance, sell offs and shake outs, long boring lulls and consolidation and in general lots of action that will look just like a historically normal OTC stock. The main difference is that the historical norm implies that an OTC runner will fall apart and go on to form more lower highs and lower lows, whereas an #OTCSET chart will theoretically find higher lows at some point, recover and go on to push through to new secular higher highs (until this long term trend is fully exhausted).

So, in theory, an #OTCSET play will have the advantage of being much more resilient than a standard OTC runner historically behaves, at least over longer periods of time. The stronger the chart pattern and the stronger the underlying turnaround story, the more confidence one can have in gambling on the bigger picture at work. With that in mind, the downside to playing strength on a secular/long term/monthly chart scale is that timing can be wildly unpredictable. Imagine buying into a healthy dip on what you believe is a strong monthly chart and you expect the long term bullish strength and energy to take back over right away, only to realize the correction had a lot more depth and time left to go. Trust me what I say that playing an #OTCSET style chart can be a catch 22. The long term strength can be your best friend or it could result in you having overconfidence in the short and medium term price action and trends.

Ultimately these are all high risk trade/investment opportunities, but the idea is that with these factors in the bull’s favor there’s a strong argument for taking these calculated gambles when the stars align. The advantage to these plays will be the extra conviction you can potentially have which means there are arguably better probabilities for success along with some shocking potential upside to help mitigate the obvious risk that all OTCs have.

To put in another way, we all love OTC stocks because of that outsized upside potential, but we all are well aware that the enormous upside comes with massive risk and in general very low probabilities for success, especially the longer you hold an OTC. So the advantage that these SET plays have is that you get the same sort of high upside potential with somewhat lower risk exposure, and the probabilities of sustained upside are infinitely greater when you’re dealing with a secular bull trend vs a secular bear trend.

To put it yet another way, the advantage that I believe the best #OTCSET plays will have is that time is actually more on the bulls’ side than the bears’ for once.

Since most experienced OTC traders have been conditioned over time to play runners as pump and dumps, these won’t be any different in that they will see plenty of flippers who will effectively stall out the momentum along the way. This isn’t something to complain about or lament, this is just the nature of things. The underlying strength that these secular trends have means that the stocks can prove to be much more resilient than flippers believe and over time it will recondition traders to see that these can go beyond what a normal pump and dump looks like. Don’t worry, the market will get there. Expect the volatility and be prepared for it.

I think most of us get into trading penny stocks hoping and dreaming about catching that one big runner which runs hundreds if not thousands of percent and helps to change our lives. To put it simply, I believe the #OTCSET is a framework that will greatly help manifest that potential into reality. It comes with lots of risks and it won’t be a quick or easy process, but I think the conditions are there for the initiated who see the bigger picture and are willing to take a calculated gamble on it.